THE DEFINITIVE GUIDE TO AIFMD ANNEX IV

THE DEFINITIVE GUIDE TO AIFMD ANNEX IV

What to know before you start reporting

What is AIFMD?

AIFMD stands for Alternative Investment Fund Managers Directive. It’s a European regulation that applies to Alternative Investment Funds (AIFs) like hedge funds, retail investment funds, private equity funds, currency brokers and real estate funds. The AIFMD regulation came to life after the financial crisis in 2008 to regulate alternative investment fund mangers (AIFMs) that were predominantly operating uncontrolled. The goal of the AIFMD is to protect both investors and the EU economy. One of the requirements is that AIFMs operating under the AIFMD have to file transparency reports ( Annex IV report) to the National Competent authority (NCA) for each of the AIFs they manage. The Annex IV report needs to comply with the latest requirements of the European Securities and Markets Authority (ESMA) in order to be accepted.

The AIFMD Annex IV report

As part of the reporting obligations under AIFMD, all European registered Alternative Investment Fund Managers marketing into the EU or EEA are required by ESMA to report to their particular jurisdiction under AIFMD to their national competent authorities (NCAs) according to Article 3 and 24. Non-EU alternative fund asset managers are also required to file an AIFMD Annex IV report in all ESMA jurisdictions into which they market.

Get a free trial

AIFMD Annex IV report categories

There are two ESMA AIFMD Annex IV report categories:

AIFM report

Providing details of the manager, and a consolidated view of the assets they manage.

AIF report

Has to be completed for each fund, contains details of the assets held by the fund, the risks to which it is exposed, the types of investor holding shares or interests in the fund and much more.

Your first time AIFMD reporting

AIFMs should start reporting from the first day of the following quarter after they have information to report, until the end of the first reporting period.

For example: when an AIFM is subject to half-yearly reporting obligations, AIFMs that have information to report as from 16 February would start reporting information as from the 1st of April to the 30th of June. AIFMs have to report only once per reporting period, covering the entire reporting period.

Get a free AIFMD Annex IV report

When you have no information for Annex IV reporting

If you don’t have any information to report yet due to a delay between authorization and registration being granted to a new AIFM and the actual start of activity, or between the creation of an AIF and the first investments, AIFMs should still report to the national competent authority by indicating that no information is available (indicate this by using a specific field).

What are the AIFMD reporting obligations?

Alternative investment fund managers (AIFMs) must report each AIF they manage or market within the European Union to the national competent authority. The timing of this reporting together with the procedures have to be followed by the AIFMs in order to prevent warnings or fines from the national competent authority.

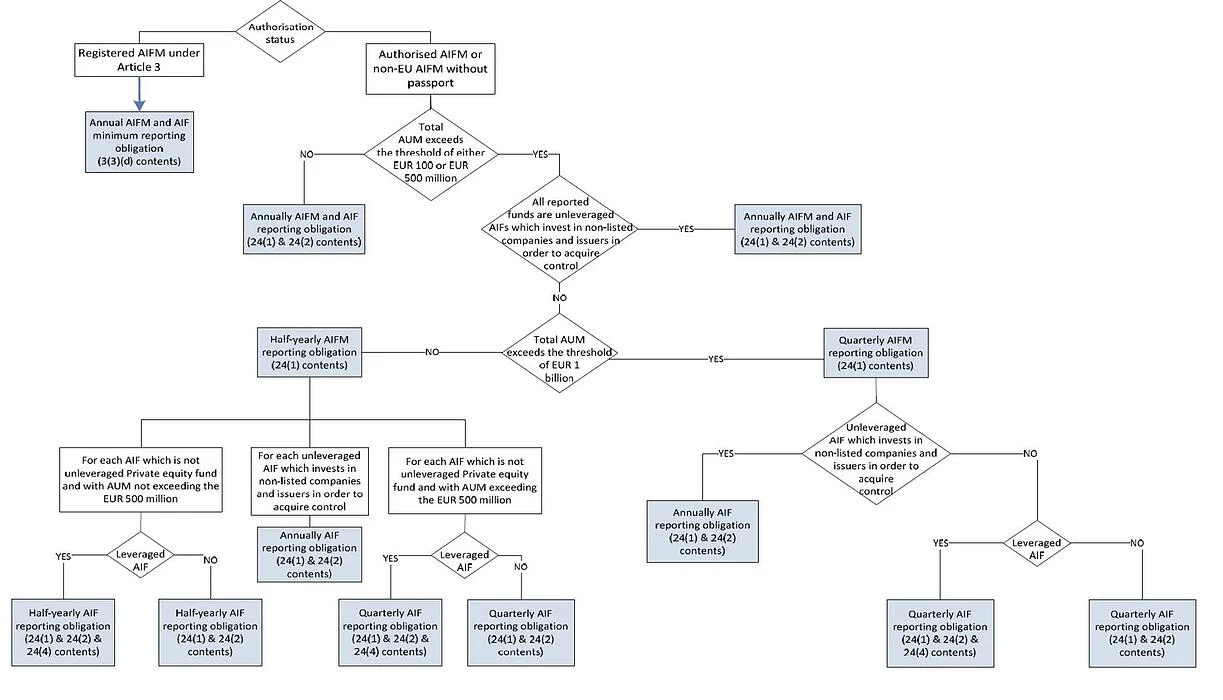

AIFMD reporting frequency

The AIFMD Annex IV transparency reporting is required on an annual, half yearly or quarterly basis depending on a number of factors including the assets under management (AuM), the degree of leverage, the type of assets held and whether the AIFM is registered or authorised.

AIFMD reporting deadline

The deadline for the first filing of the AIFMD Annex IV report is 30 days after the end of the first reporting period, once the AIFM has been authorised. In order to meet their regulatory responsibilities on time, fund managers must ensure that they have the necessary technical know-how and capabilities in place to meet the challenge of Annex IV. Fund-of-Funds get 14 days extra.

Deadline for AIFMs reporting yearly

30 or 45 days after the 31st of December.

Deadline for AIFMs reporting half-yearly

30 or 45 days after the 30th of June and the 31st of December.

Deadline for AIFMs reporting quarterly

30 or 45 days after the 31st of March, the 30th of June, the 30th of September and the 31st of December.

What are the AIFMD Annex IV reporting requirements?

The scope of AIFMD Annex IV reporting to be completed depends on a number of factors including the assets under management (AuM), the degree of leverage, the type of assets held and whether the AIFM is registered or authorized. The Annex IV (or Annex 4) reporting requirements are set by ESMA.

What transparency information is required under the AIFMD?

AUM calculation

For funds that hold derivatives the regulatory AUM is not the same as the NAV. A specific calculation is needed to value the aggregate nominal value of the derivative underlying.

Leverage

This is calculated as the risk exposure divided by the NAV – but there are two risk exposure calculation methods (commitment and gross).

Classification

ESMA guidelines prescribe a classification schema for portfolio assets and these need to be mapped against existing characteristics in your core systems.

Submission

Once finalized the report has to be rendered into the correct XML format required by the country’s national competent authority, and then needs to be submitted. This requires in-depth technical knowledge.

Control

Syntax and logical checks must be performed. Fund managers must make sure that they have a clear audit trail to explain, field by field, where the data originated from, how it was transformed, and if there were amendments, who did what.

The report

Compiling the report entails collecting, enriching, classifying and validating data from multiple sources and performing complex calculations. In total there are 41 detailed questions. Fund managers must ensure that the reports are delivered on time and in the correct format (which will depend on the system used by the national competent authority in question) .

Get a free trial

How to generate the AIFMD reporting XML

In order to create the AIFMD reporting XML you need in-depth technical knowledge of Microsoft Excel. All the XML stands for Extensible Markup Language that defines a set of rules to interpret a document. On the ESMA website you can find samples of the XML formatted file (AIFSample.xml for fund reporting, AIFMSample.xml for fund manager reporting). With the help of a developer you can convert your data from CSV into the required XML formatted file. The XML format must be compliant with the most recent format published by the ESMA. Looking for an automated solution? Then you might want to consider our AIFMD Annex IV reporting software.

How to set-up your Annex IV reporting template

In order to create a well functioning Annex IV reporting template, we highly recommend implementing validation and consistency checks to process your data correctly. To do so, you will need to find out how all the validations are done by ESMA.

If you need help, you can request our Annex IV reporting template that includes a comprehensive description of what information is required for each field. It has built-in format / content checks for multiple jurisdictions, in line with ESMA requirements.

What is the AIFMD third country passport?

The AIFMD regulates the management and marketing of alternative investment funds (such as hedge funds, private equity and real estate funds) in the EU. It provides for a European ‘passport’ which allows alternative investment funds managers (AIFMs) to manage and/or market alternative investment funds (AIFs) across the European Union (EU), on the basis of a single authorization by their local regulator.

AIFMD reporting obligations for Non-EU AIFMs

Under Article 42 of the AIFMD, a Member State can allow non-EU AIFMs to market units or shares ofAIFs that they manage without benefiting from the AIFMD passport under the National Private Placement Regime (NPPR).

Non-EU / EEA (Third Country) AIFMs, for example Cayman Islands Hong Kong, Singapore Switzerland, the United States but also Guernsey, Jersey & Isle of Man, wishing to manage or market AIFs in the EU, and EU AIFMs marketing non-EU AIFs, do not have a European passport, so any marketing of such AIFs may only be carried out in compliance with the National private placement rules of each EU country into which the AIF is sold and require regular filings of the AIFMD annex IV report to each of the regulators of the relevant EU countries.

Future outlook

In the future the AIFMD envisages the extension of the European passport to AIFMs and AIFs from third countries, and has mandated the European Securities and Markets Authority (ESMA) to advise the European Parliament, Council and the European Commission. At this moment no Third country passports have been granted.

Brexit and AIFMD Third Country Passport

Starting January 2021 the UK AIFMs will be considered as third country AIFMs and will lose their European passport and can no longer manage and market EU AIFs across the EU on the basis of authorisation by the Financial Conduct Authority. When UK funds are marketed in the EU the AIFMD Annex IV reports need to be submitted to each National Competent Authority (NCA).